Should You Invest in Real Estate Syndication or Real Estate Funds?

As an investor, it is important for you to choose what investment is the right fit for you. Some investors prefer to be involved in their investments and that is part of the reason why they choose to invest in “buy and sell” or they choose to manage their own stock investment. On the other hand, there are those that want to earn money by investing passively since they have a full-time job which they might not be ready to give it up just yet but know that they want to invest in real estate. The syndication model and real estate funds have a variety of characteristics in common and one of these commonalities is that they are both passive investments.

To better understand, let’s do a quick rundown on the similarities and differences of these investments.

In real estate syndication, a sponsor looks around to vet a good property to invest in. The goal here is to look for properties that have a higher earning potential not just for the immediate future but in the long term as well. They choose to invest in properties that have room for improvement and are likely to increase their profit margins. Once everything is set, investors will pool their funds to purchase the property. There will be no other investment apart from the specific property that has been vetted and chosen.

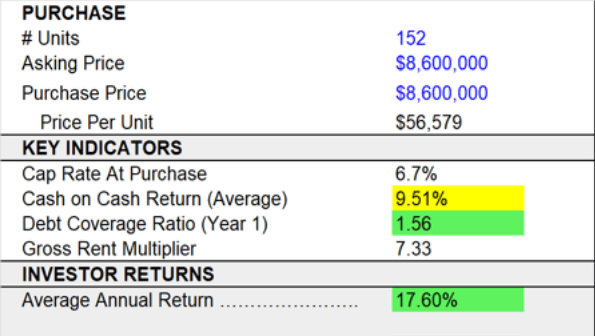

The very first property that we funded had an AAR that reached up to 17.60% and our investors were thrilled. Here is a look at those numbers:

So aside from syndication, there are also RE Funds. In this type of investment, the sponsor raises the funds for purchases of different properties, and they manage and sell when they think it is the right time. Essentially, your investment will be spread across different investments. This investment is considered a blind trust investment since you won’t be able to see what properties are being invested in at the start of the fund.

Diversification

If you are looking to focus on one investment property at a time, then syndication would be a good option for you. Your investment will be focused on funding a specific property. If you are looking to diversify your investment but still want to know in which properties you are going to invest in, you will need to invest in different projects or syndication sponsors.

If you are looking to diversify your investment but with only one sponsor, then you can choose to invest in a real estate fund. The sponsor will invest your money in different properties they think will have the potential to earn profit.

Evaluation

In the real estate fund model, your evaluation will focus on choosing the right sponsor for you to work with. You will not be able to evaluate properties that they are going to invest in, so it is important to know their track record which essentially means you need to know where and what type of properties they are looking to invest in. You would like to invest with someone who has been around for quite a while as they have more experience in this type of investment and therefore has much better knowledge of how to operate the properties profitably.

With real estate syndication, you will be able to evaluate the property that you are going to invest in as well as the sponsor that you are going to work with. You will see the potential of the property in earning profit as well as the sponsor’s track record.

Investment Term

For both types of investments, the terms are typically in years. In syndication, some terms last 3 to 7 years but there are terms where the timeframe is much more than that. In this scenario, sponsors determine the right time to sell the property.

Real estate funds can be open or closed funds. Open funds operate in a cycle where your money is invested in different properties. In these types of funds, you can decide when you want to pull out your investment although there are instances where agreement terms will be applied should you pull out your investment earlier. Let’s say for example that if you pull your capital contribution out within the first 2 to 3 years, fees will be applied but if you decide to keep your funds in longer you will be able to earn additional incentives depending on your agreement.

For closed funds, you are given a range of how long the investment will run. The investment ends once the last property is sold. So, if they give you a term of 5-7 years, it could still take a longer or shorter amount of time depending on the properties' performance that is in the fund. Also left to the discrepancy of the sponsor of the deals. In these closed funds, most capital is in for throughout the duration of the fund.

Minimum Investment

The amount of money that you are willing to invest also plays a significant role in investing. To invest in syndication and real estate funds most commonly require a minimum of $50,000 and sometimes higher since the properties that you are going to invest in cost millions and have higher returns.

Returns

Returns from syndication and real estate funds are the same. With the most common structure, you get what they call “preferred returns” and profit on top of that. Usually, preferred returns are sent to you quarterly depending on the terms agreed upon and the profit then gets equally divided among the investors, again on a set percentage that was agreed upon. There are also payments on refinances as well as the profits from the sale of the properties.

As you can see there are a variety of similarities and differences between the two types of investments. Each has its own pros and cons, and each can be beneficial for you but at the end of the day, you choose depending on what works best for your situation. Want to know more? Set up an appointment with me today and let’s choose which investment plan works best for you.